About Aramco

Aramco is the state-owned Saudi Arabian oil and gas company. Aramco is the world’s largest corporate greenhouse gas emitter. It is estimated to be responsible for over 4% of the entire world’s GHG emissions since 1965. Aramco’s 98.5% owner, the Saudi Arabian government, has a long history of fighting efforts to tackle climate change.

The company is led by CEO Amin bin Hasan Al-Nasser and in 2020 Forbes reported its sales at $329.8 billion. In 2019, 1.5% of Aramco was listed on the Saudi Arabian stock exchange, raising $25.6 billion, and valuing the company as worth about $1.7 trillion - the largest company in the world.

It was estimated in 2019 that Saudi Aramco plans to produce and sell the equivalent of 27 billion tonnes of carbon dioxide between 2018 and 2030. This is an enormous amount, equivalent to 4.7% of the total “carbon budget” that the IPCC estimated the entire world had left in 2018 for a 50% chance of meeting the Paris Agreement’s 1.5°C goal. According to the IPCC, a 66% chance requires shrinking the global carbon budget by almost 30%.

27bn

4.38%

8

2077

The truth behind the greenwashing

The Transition Pathway Initiative considers that the company’s current emissions intensity is far from being aligned with the Paris Agreement target of “well below” 2°C, and are not even in line with governments’ current pledges, which would see the world warm by around 3.2°C. Aramco has no plans to reduce oil and gas production by 2030, the date by which IPCC scenarios say emissions from fossil fuels will need to have substantially reduced.

But its ads tell a different story…

Climate pledges

Saudi Aramco is a member of the Oil and Gas Climate Initiative, a group of oil majors who contribute to a +$1 billion fund to develop technologies that could help lower emissions in the sector. Collectively, the group has pledged to reduce the amount of carbon dioxide emitted through their oil and gas production processes (Scope 1 and 2 emissions) by 13% by 2025.

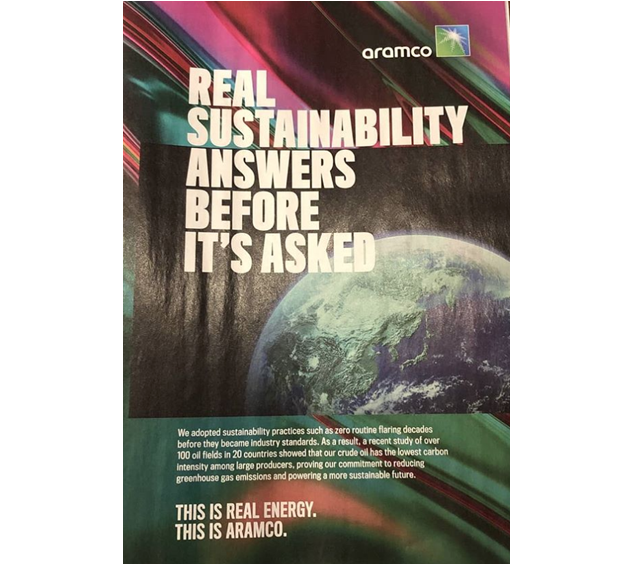

In July 2019, Aramco joined an initiative led by the World Bank to stop the practice of the routine burning, or “flaring”, of unwanted gas during oil production by 2030.

Aramco’s website says: “Our contributions to the climate challenge are tangible expressions of our ethos, supported by company policies, of conducting our business in a way that addresses the climate challenge. The challenge is to meet the world’s energy needs while managing emissions. We are answering this by focusing on: Carbon Intensity, Sustaining low carbon intensity crude oil, Flaring reduction, Research and development, Emissions to value, Impactful collaborations.”

The company’s website also states “Sometimes, making an impact is about reducing your impact. For us this means pushing the frontiers of knowledge and the boundaries of technology to deliver creative and innovative engineering solutions that enhance our productivity and efficiency while minimizing the environmental impact of our operations.”

The reality

Aramco operates over 100 oil and gas fields. These include the world’s second largest onshore oil field, the Ghawar field, the world’s largest offshore oil field - the Safaniya field - and Jafurah, the largest shale gas field outside the US. Aramco’s proved oil and gas reserves dwarfed the combined reserves of Exxon, Chevron, Shell, BP and Total. At the 2020 production rate, Aramco’s proved reserves could be burned until 2077.

Despite this, Aramco aims to grow its reserves. Its accounts listed fossil fuel exploration and evaluation assets of $5.6 billion in 2020. After discovering three new oil and gas fields in 2019, Aramco said that its “exploration activities led to the discovery of seven new fields and one new reservoir in 2020”. In 2020, the Saudi government, which owns the majority of Aramco, directed the company to increase its ‘maximum sustainable capacity’ for fossil fuel production from 12 million barrels of oil per day to 13 million.

Analysis shows that global existing, developed fossil fuel reserves already exceed our carbon budget for both 1.5°C and 2°C warming.

Business strategy: more oil

Aramco’s 2020 Annual Report sets out a 7-point business strategy. The description to Point 1 begins “Aramco intends to maintain its position as the world’s largest crude oil company by production volume”.

Point 3 is to “Expand gas activities”, which the company says is “to meet the large and growing domestic demand for low-cost cleaner energy”.

The company does not disclose the emissions produced by its fossil fuel products (Scope 3 emissions), which are estimated to account for around 90% of Aramco’s emissions. Through joining the Oil and Gas Climate Initiative in June 2020, Aramco committed to pledges that permit it to increase its emissions overall, reduce the carbon intensity of its business by just 13% and do not cover its downstream Scope 3 emissions.

In 2020, Aramco bought a majority stake in the Saudi Basic Industries Corporation for the vast sum of $69 billion. CEO Amin Nasser said: “It is a significant leap forward, which accelerates Aramco’s downstream strategy and transforms our company into one of the major global petrochemicals players”. The company has described its long-term fossil fuels downstream strategy “to grow its integrated refining and petrochemicals capacity and create value from integration across the hydrocarbon value chain”. The petrochemicals industry relies on fossil fuels for raw material and for power and is highly carbon-intensive. It has been called a “key blind spot in the global energy debate”. It is estimated that emissions from the production of plastics, a petrochemical product, is on track to consume at least 12% of the earth’s remaining carbon budget by 2050.

Sustainability through technology and innovation?

Aramco’s last business strategy point, point 7, is to “Operate sustainably by leveraging technology and innovation”. Aramco does not disclose how much of its $27 billion capital expenditure in 2020 went to the research into low-carbon technology and innovation, which it lists on its website in a section called “Making a difference – Planet”.

Aramco has a carbon capture project at its Hawiyah Gas Plant, which it says captures 30 million standard cubic feet of CO2 daily. The captured CO2 is pumped into an oil field for ‘enhanced oil recovery’ – in other words to extract more oil. The company claims this allows it to “increase our oil production sustainably”, but the Hawiyah project accounts for a miniscule amount of Aramco’s emissions – in the region of half a million tonnes of CO2 per year, or 0.03% of its estimated 2019 Scope 3 emissions.

Aramco also highlights its project to plant 2 million mangroves, saying that this is “a powerful solution” which “provides a massive natural sink for carbon dioxide”. It describes mangroves as “front-line climate warriors”, estimating that each mangrove sequesters “up to 1.5 metric tons of carbon over its average 60-year lifetime”. Aramco’s 2020 Annual report says that it has planted or restored 5.3 million mangroves in total. Assuming the mangroves last until 2060 (despite expected climate change impacts on ecosystems), this equates to about 130,000 tonnes of CO2 every year. In 2019, Aramco’s Scope 3 emissions were estimated at 1,600 million tonnes of CO2 equivalent – over 12,000 times more.

In January 2020, Aramco exported a shipment of 40 tonnes of ‘blue’ ammonia produced from fossil fuels along with carbon capture, which it says was “reinforcing Aramco’s focus on the reduction of CO2 emissions”. The company said that 50 tonnes of CO2 were captured in the shipment’s production, some of which was used for ‘enhanced oil recovery’ – i.e. extracting more oil – and most for producing ethanol. ‘Blue’ ammonia is a method of transporting energy made from fossil fuels with carbon capture – it is not ‘green’ ammonia, or energy made from renewables.

Although Aramco’s Annual Report says that the ammonia was “for use to generate power with a zero-carbon footprint”, this does not acknowledge the GHG emissions from the other parts of the ‘life-cycle’ - from the fossil fuels' extraction, production and transport, from the further oil extracted and methanol produced using the captured CO2, and from the energy used in these processes. For hydrogen, which is used to produce ‘blue’ ammonia, UK scientists say that life-cycle emissions reductions of only 60-85% are achievable: “for net-zero carbon hydrogen production, current projections suggest that this process can only be part of a transition to a zero-carbon solution”. Aramco’s announcement also does not disclose what percentage of life-cycle emissions were captured.

A drop in the ocean

While Aramco lists its participation in the Oil and Gas Climate Initiative (the OGCI) as one of its environmentally friendly actions, the $100 million funding given by member companies to the initiative has been described as a “token” gesture by the Union of Concerned Scientists and a “drop in the ocean” by the Energy and Climate Intelligence Unit thinktank. Aramco does not disclose its advertising spend, but in 2019, Aramco reportedly put aside £200 million for marketing in advance of plans for its flotation on stock markets. The OGCI’s investment portfolio is focussed on projects such as uses for carbon dioxide, efficient petrol combustion engines and methane emissions controls which relate to continuing use of fossil fuels, rather than projects relating to renewable energy.

The OGCI describes itself as “Leading the industry response to climate change”, and has a collective ambition for member companies to reach an upstream carbon intensity of 20 kg CO2e/boe and an upstream methane intensity of 0.2% by 2025. It is not clear what Aramco’s commitment to these ambitions means in practice, as Aramco already reports much lower figures for its upstream emissions – an upstream carbon intensity of 10.1 kg of CO2e/boe and an upstream methane intensity of 0.057%

Expanding recognition of Aramco’s brand

Point 4 of Aramco’s 7-point business strategy is to “Expand global recognition of Aramco’s brands”, and the company says that “For example, in March 2020, Aramco announced a long-term global partnership with Formula 1”.

In April 2020, Aramco withdrew its advertisement campaign in which it claimed to be “powering a more sustainable future” after over 60 complaints were made to the UK advertising regulator including complaints that the adverts were misleading in the context of an advertisement for an oil company.

60

Under threat from electric vehicles

The company has promoted a prototype truck with carbon capture technology which it says caught 40% of CO2 from the tailpipe in lab tests, in advertisements which state that Aramco is “innovating for a better future”. The adverts do not compare the prototype truck’s emissions or cost with electric vehicles. Aramco’s business model is under threat from electrification of transport and it has paid for press content arguing for investment in fossil fuel cars alongside electric vehicles, and supported research into China’s electric car policies.

More to explore

Greenwashing Explained

We’ve put together explainers of some of the key terms and phrases used in these Greenwashing Files.

What are GHGs?

GHGs stands for greenhouse gases - this is the group of seven gases generally seen as contributing to global warming, including carbon dioxide (CO2) and methane (CH4).

What are the Paris goals?

The goals which countries agreed on in Article 2(1) of the 2015 Paris Agreement on climate change, to hold the increase in global average temperature to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C above pre-industrial levels.

What is CO2e?

CO2e stands for carbon dioxide equivalent, a measure of greenhouse gases. Other non-carbon dioxide greenhouse gases are converted to the equivalent amount of carbon dioxide on the basis of their global warming potential in order to produce a single greenhouse gases measure.

What are Scope 1-3 emissions?

Scope 1-3 emissions are the most widely used international carbon accounting tool. The Greenhouse Gas Protocol categorises a company’s GHG emissions into three groups:

- Scope 1 covers direct emissions from the company’s owned or controlled sources (e.g. burning fuel, company vehicles, emissions from the company’s own industrial processes).

- Scope 2 covers indirect emissions from the generation of electricity, steam, heating and cooling consumed by the company.

- Scope 3 includes all other indirect emissions that occur in a company’s value chain, including emissions from the use of its products.

Is gas clean?

Many fossil fuel companies make questionable claims about the sustainability of fossil fuel 'natural' gas, frequently marketed as ‘the cleanest-burning’ fossil fuel. Burning gas may produce less CO2 than burning coal or oil, but it is still carbon intensive, and not a viable long-term energy source – unlike renewable energy. Climate goals mean that gas use must be reduced, not increased.

On a full ‘lifecycle’ basis, generating electricity by burning gas produces on average more than 10 times the emissions of real low-carbon electricity sources like solar, and more than 40 times the emissions from wind power. As well as emitting significant CO2 when burnt, extracting, transporting and storing fossil fuel gas leaks methane, a powerful greenhouse gas. How much is leaked is critical - if leakage isn’t kept to low enough levels, the overall climate impact of gas can be worse than coal, the dirtiest fossil fuel. Measuring leakage is challenging, and significant advances in reducing leakage are needed.

Is gas a backup for renewables?

Currently gas power is not typically limited to a ‘backup’ function when variable wind and solar renewable energy drops off. Instead, gas is a significant source of regular electricity generation globally, providing electricity that could be replaced by increasingly cheaper renewables. Meanwhile, investments in new gas infrastructure with decades-long operating lifetimes are set to 'lock in' unsustainable greenhouse gas emissions.

Is carbon offsetting the answer to fossil fuels?

Companies’ climate plans increasingly rely on vague talk of huge ‘offsets’ or ‘nature-based solutions’ schemes instead of near-term reductions in fossil fuel production. These plans, even if costed and scalable, can in practice often involve vast commercial monoculture tree plantations, which can cause negative impacts on biodiversity and communities, and struggle to guarantee carbon storage for the hundreds of years which fossil fuel emissions will remain in the atmosphere. Some companies plan to claim the carbon ‘credits’ from existing forests by relying on questionable claims that the corporate offset schemes are the only way to stop deforestation. Carbon removals and offsetting schemes like this can be a part of tackling climate change. But they are not an alternative to prioritising cutting emissions for any sector, let alone for the fossil fuel industry.

Can we rely on carbon capture technology?

Analysis shows that reaching climate targets whilst continuing with today’s oil and gas projects would require a rapid and massive acceleration in carbon capture and storage (CCS). Despite long-running talk of big plans for CCS, companies have never operated it at anything like sufficient scale.

Today, global operational CCS capacity accounts for about 0.1% of global fossil fuel emissions, and the technology cannot capture 100% of emissions. Some companies plan to use, rather than store, captured CO2, often to extract yet more oil. CCS also does not avoid upstream methane emissions and may even increase these due to the additional energy required to run the technology.

There is a history of repeated failures to scale-up CCS, and plans for economically viable CCS have been called ‘wishful thinking’. Experts highlight numerous problems and barriers to short-term deployment and consider that any future development of CCS will now be too little, too late for urgent pathways to a safe climate.

Is biomass sustainable?

Some companies are now turning from fossil fuels to forest biomass energy. Wood biomass is treated as ‘renewable’ under EU and UK law, based on a carbon accounting rule where the GHG emissions from burning biomass are counted as ‘zero’.

However, in reality, burning wood biomass can produce even more CO2 emissions than burning fossil fuels. Sourcing the fuel for biomass through logging is also linked to deforestation - degrading the natural carbon sinks we need for a safe climate. The carbon accounting rule is highly controversial, and does not mean that biomass is in reality ‘low-carbon’ or ‘carbon-neutral’. Because of this, scientists warn that burning wood biomass for energy creates a double climate problem - because it is a false solution to climate change that is replacing real solutions.

What are carbon emissions targets?

Emissions intensity targets – An intensity target is relative to product output, for example the amount of GHGs per barrel of oil produced.

Absolute emissions targets - An absolute target simply refers to the overall amount of GHG emissions attributable to the company. Under many intensity targets, a company can maintain or even increase its overall GHG emissions, provided it increases production enough.

What does CCUS mean?

CCS stands for carbon capture and storage. This is the process of trapping carbon dioxide produced, for example, by burning fossil fuels and then storing it permanently so that it will not contribute to global heating. CCUS, or carbon capture, use or storage, additionally refers to the use of trapped carbon dioxide for some other process.

How do you define capital expenditure?

Capital expenditure is investment by a company on major fixed assets such as buildings, vehicles, equipment or land. This is different from operating expenditure, which represents day-to-day recurring costs like salaries or rent.

Disclaimer

The Greenwashing Files have been produced and published by ClientEarth, an environmental law charity registered in England and Wales, with research assistance from DeSmog. For more details, please refer to the registration details in the footer of our website. The information included in the Greenwashing Files is as of 25 March 2021.

The Greenwashing Files have been written for general information purposes and do not constitute legal, professional, financial, investment, shareholder voting or other advice. Specialist advice should be taken in relation to specific circumstances. Action should not be taken on the basis of this publication alone. ClientEarth endeavours to ensure that the information it provides is correct, but no warranty, express or implied, is given as to its accuracy and ClientEarth does not accept responsibility for any decisions made in reliance on this document. The Greenwashing Files contain hyperlinks to other websites as a convenience to the reader. Because ClientEarth has no control over these sites or their content, it is not responsible for their availability, and ClientEarth is not responsible or liable for any such sites or content.